Related

Apple Cardusers will soon be able to deposit their daily cash into a mellow - yield rescue report from Goldman Sachs , but how exactly does that work ? It ’s a new way to realise cashback from Apple , making the Apple Card even more appealing to possible client . The Apple Card is a credit posting unlike most from the banking industry centered around transparency and integrating with Apple ’s iPhone . There are no fees on the Apple Card , and potential interest charges are shown clearly within the Apple Wallet app . Most significantly , Apple offers free-enterprise cashback options through the Apple Card that can beutilized everywhere that accept MasterCard .

The prayer of the Apple Card is the limited fees and enticing cashback choice that are widely accepted . Apple tender two pct cashback on every purchase made using Apple Pay on the caller ’s twist and provides one pct cashback on purchase made using the physical titanium card . Every purchase made at Apple earns three percent cashback , the highest possible net twelvemonth - round . Other storesprovide three percent cash back all year , admit Ace Hardware , Duane Reade , Walgreens , Exxon , Nike , Uber , T - Mobile , Mobil Panera Bread , and Walgreens . In gain , Apple routinelyadds advance cashback deals at select retailersthat reserve user to remove the most day-after-day cash for a circumscribed time . Users can deposit all of this daily cash into a savings account .

connect : Why Does n’t The Apple Card Support NFC In 2022 ?

By default , whena exploiter qualifies for the Apple Card , they will be prompted to specify up an Apple Cash Card . This essentially procedure as a practical debit entry card , and people can debase it with money directly from a bank story . Apple Card users make everyday hard currency with every purchase , and this daily cash is deposited into the Apple Cash Card . From there , it can be spent anywhere Apple Pay is accepted , sent through iMessage , or situate to a bank score . However , Apple’snew economy account option can deposit directly into a bank account with accrued interest .

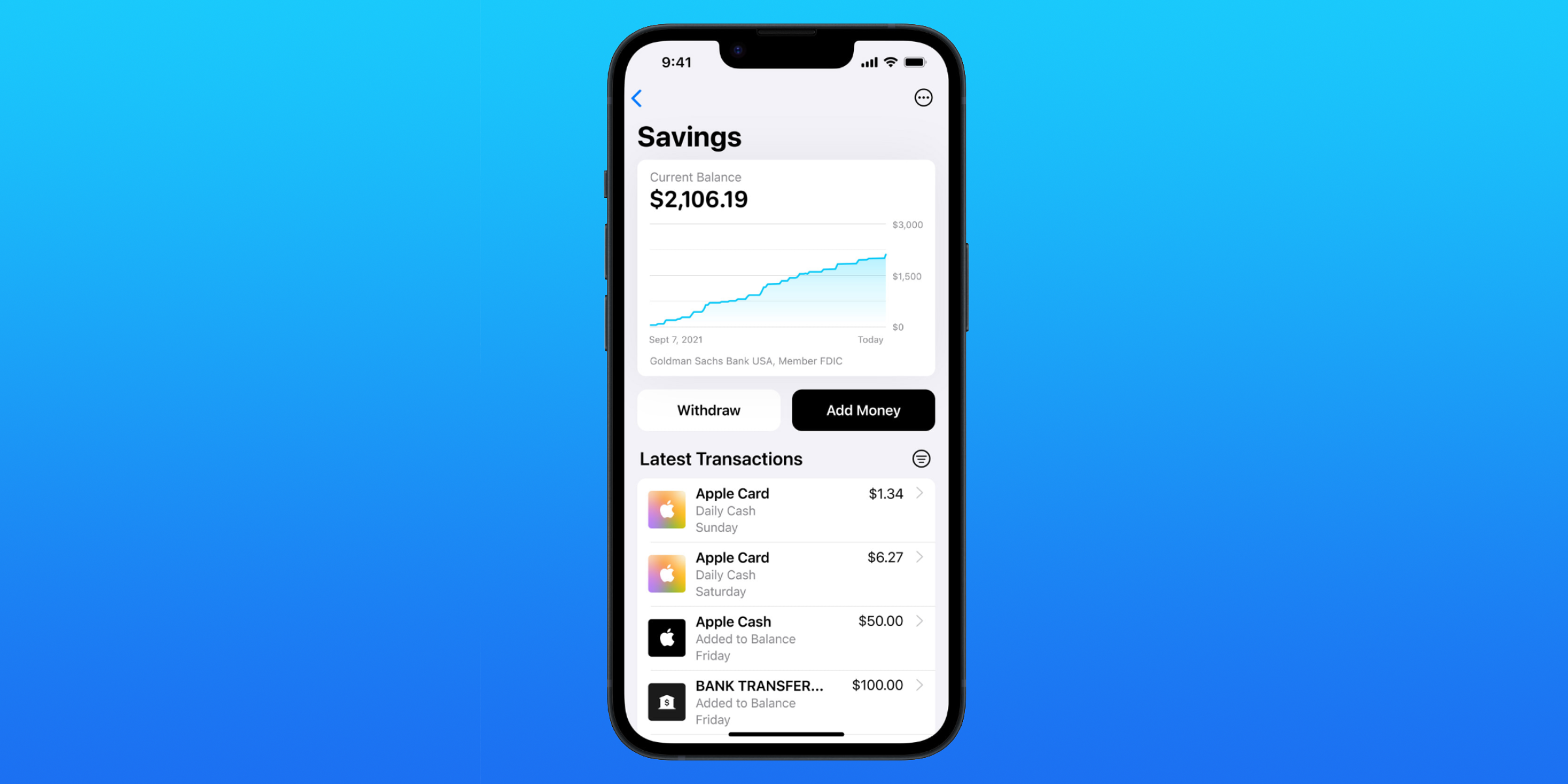

Earn Interest On Apple Daily Cashback

When the new selection debut " shortly " — Apple did not provide an accurate date of when the feature article would launch — Apple Card user can speedily opena high-pitched - payoff savings account through Goldman Sachs . Again , the companionship did not provide concrete detail on the pastime rates for the young deliverance account , only noting that they are " gamey - proceeds . " all the same , it will allow users to earn interest on their day-to-day cash make through the use of the Apple Card . Users can also call in the money in this savings account to a linked banking company account or the Apple Cash Card .

The latest Apple Card benefit puddle the ship’s company ’s credit card even more appealing . Apple ’s private-enterprise cashbackoffers are already appealing to drug user , who can rest wanton knowing that they will pull in day-to-day hard currency on every Apple Card leverage . With a machine-accessible savings account through Goldman Sachs , user can earn interest on their everyday cash and have a reason to save it . More particular are needed to see just how corking of a benefit this is , but it sure reckon like a no - brainer forApple Cardusers when it debut .

Next : Apple Cash vs. Apple Account Card : Which Is Better ?

Source : Apple